Lee Clements on how to construct next generation climate fixed income indexes

Lee Clements, from FTSE Russell, talks to Climate Action about how to construct next generation climate fixed income indexes, the opportunities and challenges of sustainable investing within fixed income.

Lee Clements, from FTSE Russell talks to Climate Action about how to construct next generation climate fixed income indexes, the opportunities and challenges of sustainable investing within fixed income.

What is entailed in building a climate adjusted government bond index and why are they needed now?

The world is increasingly focused on how countries and economies will be impacted by climate change and what governments can do to mitigate and adapt to it. COP26 acted as a focus of this attention. As such, investors are increasingly focused on assessing climate risk across their entire portfolio, including government bonds. To build a climate risk-adjusted government index it is necessary to have a process which incorporates the multiple types of climate risk, the forward looking nature of the climate risk and the efforts of countries to address climate risk. The process needs to collect sufficient KPIs to combine all of these factors in a single score to assess relative climate risk between groups of countries and hence adjust their weight in the index.

What design and implementation issues have you encountered when incorporating risks into government bond indexes?

The main challenge is that climate risk is very much forward looking, so you cannot rely on analysing historical relationships. Incorporating and weighting the different types of risk is also a challenge, as is measuring the end impact. There is a lot of data out there for KPIs, but making it forward looking and adjusting for time lags can be a challenge.

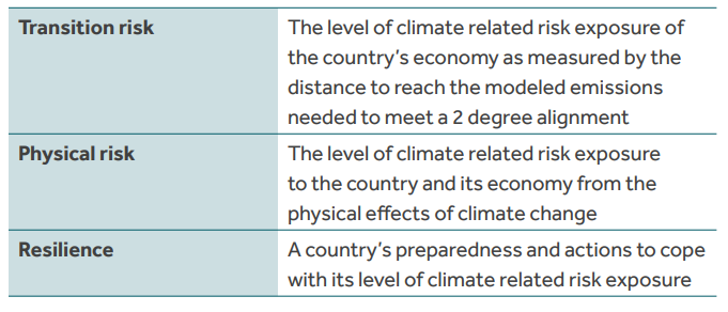

Can you explain the difference between physical, transition and resilience risk?

If we talk about the construction of the FTSE Climate Risk-Adjusted Government Bond Index Series, which measures the performance of fixed rate, local currency, investment-grade sovereign bonds, a tilting methodology is incorporated to adjust index weights according to each countries’ relative exposure to climate risk, with respect to resilience and preparedness to the risks of climate change.

Firstly, physical risk is the potential damage climate change can inflict on a country and its economy. It can be in a number of forms e.g. coastal flooding, forest fires etc. and can financially take a number of forms, destruction of assets, lost earnings from economic disruption, costs of dealing with natural disaster and/or adapting to them.

Secondly, transition risk is the risk to the economy of adapting to the lower carbon economy needed to mitigate climate change. It can take a number of form, falling GDP (and associated loss of tax revenue) from areas such as fossil fuels, autos, some areas of agriculture, stranded assets in these areas, the costs of transforming areas of the economy to new technologies (e.g. power generation, transport etc) and also opportunities such as growing GDP in the green economy.

And thirdly, resilience is the degree to which a country is prepared to deal with climate change and the actions they are taking to address it. We divide this in institutional, social, economic and ecological resilience.

Why do you think there is a lack of climate based investment products in the fixed income market, particularly in sovereigns and do you expect this to change any time soon?

Traditionally investors viewed fixed income to be a safer asset class and that climate change risk was beyond its investment horizon. Additionally, it is easier to create climate solutions in equities and they are seen as having more stewardship and engagement potential. However improved understanding of significant and growing impact of climate change (both transition and physical) and the need to assess climate risk across whole portfolios (in many cases regulatory driven) we are seeing rapid growth in the sustainable fixed income market.

How are investors currently measuring climate risk in their government bond portfolios?

If measured at all, it is generally a basic carbon intensity foot printing, which is inherently backward looking and doesn’t take into account different types of climate risk, alignment to climate reduction pathways etc. We expect to see growing interest from investors in index-linked funds and investment products. Both institutional and private asset owners are increasingly including climate objectives in their decision making and are adjusting fixed income portfolios based on climate concerns. Some large asset managers are starting to fill the gap with sustainable fixed income funds, for example iShares launched an ETF in 2020 consisting of sovereign debt from European Monetary Union (EMU) countries that tracks the FTSE Advanced Climate EGBI.

How do you source and collate your climate risk modelling data and how quickly does the data become obsolete?

We source a wide range of data (through our Beyond Ratings team), directly from countries, from supranational agencies (e.g. World Bank, UN) and some from academic institutions. In some cases it can be used directly, but in others the accounting, parameters or time frames are not aligned, so we developed various methodologies to make it consistent and comparable across companies. In addition we have developed various models to transform this data into assessment of forward looking risk/performance/commitments and how to combine different data to assess overall risk. The data itself doesn’t tend to become obsolete (although can become dated) but as new datasets, assessment methodologies and models develop the state of the art in assessing climate risk is rapidly moving forward.

What recent progress are you seeing with building the Sustainable Development Goals into fixed income indexes?

By building a customised benchmark that applies specific UN Sustainable Development Goals (SDGs) to the Euro Credit market, FTSE Russell is continuing its long and cutting-edge partnership with Pensioenfonds Detailhandel. The FTSE Euro Credit SDG-Aligned Bond Index applies a simple and transparent set of criteria that increases the fund’s exposure to bonds issued by companies and sub-sovereign entities scoring highly on issues such as decent working conditions, climate action and sustainable consumption and production. FTSE Russell is continuing to build the next generation of sustainable fixed income indexes that meet diverse investment objectives such as climate risk mitigation, ESG screening or alignment with SDGs.